bank islam moratorium

KUALA LUMPUR Aug 2 Bank Islam Malaysia Bhd has strongly urged vulnerable customers impacted by the Covid-19 pandemic to approach its officers and staff for the best. Bank Islam Malaysia has announced a six-month moratorium for customers from the B40 bottom 40 M40 middle 40 and T20 top 20 categories and the MSME segment affected by the COVID-19 pandemic Bernama reported.

Kami sedia membantu anda.

. Those who are eligible can apply for a moratorium of. Customers may visit the banks network of branches from Aug 7 onwards to discuss solutions that best fit their financial situation. Para pelanggan yang ingin membuat permohonan moratorium boleh menghubungi Pusat Panggilan Bank Islam di talian 03-2690 0900 atau ke cawangan Bank Islam terdekat.

Customers under the banks House Financing Personal Financing and Vehicle Financing facilities are eligible to apply for a moratorium of up to six months. On the automatic moratorium which ends at the end of this month Muazzam said the bank had already identified and contacted the customers who lost their jobs or had their salary reduced as a result of the movement control order. Application is open for customers from the B40 M40 or T20 the Microenterprises and SME segment affected by the ongoing pandemic.

Program Bantuan Pembayaran yang tersenarai dibawah adalah untuk membantu pelanggan yang. Kini adalah masa yang sukar kerana ramai antara kita terkesan akibat pandemik Covid19 serta penguatkuasaan pelbagai sekatan pergerakan termasuk Perintah Kawalan Pergerakan. In a media release dated August 2 2020 the Chief Executive Officer of Bank Islam announced that Bank Islam will initiate additional moratorium assistance following the expiry of the six-month blanket moratorium assistance.

Bank Islam Malaysia Bhd has strongly urged vulnerable customers impacted by the COVID-19 pandemic to approach its officers and staff for the best repayment arrangement as the current moratorium period ends on Sept 30. Namun kami sedia membantu sekiranya anda memerlukannya. We are keeping abreast with the latest news on the flooding.

Saat PKP 30 ini memang sangat sesuai untuk individu yang mempunyai pinjaman peribadi pinjaman kereta dan pinjaman. The customers will continue paying the same instalment amount after the moratorium period ends. A moratorium is the stopping or delay of something for an agreed period of time To simplify it according to BNM during this period borrowerscustomers with loanfinancing that.

The moratorium is part of its efforts to help customers cushion the adverse impacts of the Covid-19 pandemic. Sila Isi e-Borang Ini Portal Kini. Menerusi bantuan moratorium automatik ini.

Program Bantuan Pembayaran yang tersenarai dibawah adalah untuk membantu pelanggan yang. Kini adalah masa yang sukar kerana ramai antara kita terkesan akibat pandemik Covid19 serta penguatkuasaan pelbagai sekatan pergerakan termasuk Perintah Kawalan Pergerakan. Selain moratorium Maybank dan moratorium Bank Rakyat rakyat Malaysia juga boleh mohon moratorium Bank IslamMohon izin untuk kami kongsikan cara untuk memohon bantuan bayaran PEMULIH dari Bank Islam ini khas untuk pelanggan individu.

Bank Islams business customers and eligible small and medium enterprises can apply for up to RM1 million in financing with a tenure of up to 55 years and a moratorium of up to six months at an affordable financing rate of 375 per cent per annum. Bank Islam to help customers rearrange loans New Straits Times. Our e-mail correspondent unit operation hours are from Monday to Friday 900am to 600pm.

For any urgent matters especially to report on a lost or stolen card please immediately call Bank Islam Contact Centre at 03-26 900 900 24hours7days a week. We dont operate on weekends and public holidays. Bank Islam is one of the first lenders to make public the number of applications it has approved.

Bank Islam Malaysia Berhad Bank Islam is offering a dedicated Program Prihatin to assist customers affected by floods. Borang Permohonan Moratorium Bank Islam PEMULIH Mulai 7 Julai 2021. Dibawah ini adalah senarai Bank beserta dengan Link Terkini untuk info lanjut dan cara Permohonan Moratorium - Moratorium Maybank KLIK SINI Moratorium Bank Rakyat KLIK SINI Moratorium Bank Islam KLIK SINI Moratorium CIMB KLIK SINI Moratorium BSN KLI KSINI Moratorium Public Bank KLIK SINI Moratorium Ambank KLIK SINI.

Subsequently Bank Islam launched the Program Prihatin Bersasar PPB and Program Bantuan Pembayaran Balik. Bank Islam Malaysia Berhad. Bank Islam Malaysia Bhd Bank Islam has urged customers who are heavily affected by Covid-19 to approach it to work out an arrangement following the end the.

BANK Islam Malaysia Bhd is lending a hand to flood victims with an aim to ease their financial burden by introducing its Prihatin Programme. Bagi pelanggan yang telah menerima Program Prihatin Banjir Program Pengurusan Kewangan dan Ketahanan URUS tersedia untuk meringankan beban anda dalam membuat pembayaran ansuran untuk segala komitmen pembiayaan anda. This program aims to alleviate the financial burden of flood victims who are customers under the facilities of Home Financing Personal Financing and Bank Islam Vehicle Financing.

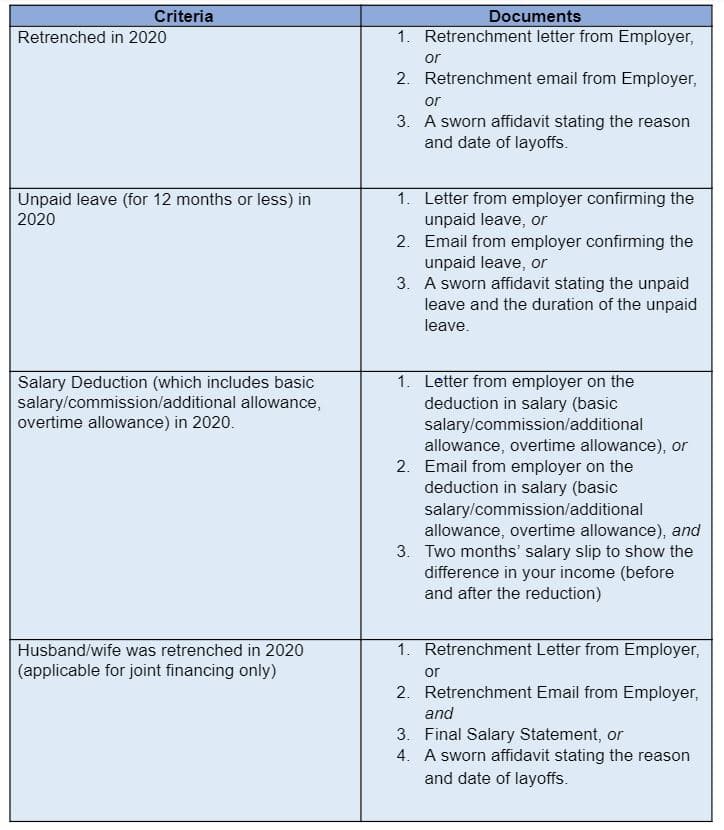

Upon the expiry of the blanket moratorium on 30 September 2020 banks in Malaysia would be focusing on targeted assistance approach specifically for individual customers who have lost their jobs in 2020 and to those individual customers who are suffering from a drop in income due to the COVID-19 pandemic. Find out how we provide relief to the underserved communities and frontline workers and help support customers and peoples livelihoods in the face of COVID-19 pandemic. In a statement today Bank Islams chief executive officer Mohd Muazzam Mohamed said the bank has.

Bank Islam Trust Company Labuan Ltd The first full-fledged Shariah compliant Labuan Trust Company incorporated under the Labuan Companies Act 1990 and registered as a Trust Company under the Labuan Financial Services and Securities Act 2010. He added that Bank Islam has assisted more than 394000 customers since the six-month moratorium was implemented in April. Bank Islam Targeted repayment assistance Applica.

Untuk semua pelanggan Bank Islam yang ingin memohon pengecualian penangguhan bayaran pembiayaan anda boleh mengisi e-borang penangguhan pembayaran. Bank Islam Malaysia Berhad. Bank Islam Malaysia Berhad.

Namun kami sedia membantu sekiranya anda memerlukannya. Melalui URUS anda berpeluang untuk mengukuhkan kembali kedudukan kewangan anda terutama sekali di. In supporting the Governments Perlindungan Rakyat dan Pemulihan Ekonomi PEMULIH package PRA allows eligible customers to choose either a 6-months moratorium or 50 monthly instalments reduction for six months.

Bank Islam akan terus komited untuk membantu dan menyokong negeri-negeri yang terjejas dalam memastikan kebajikan dan kepentingan rakyat terjamin tambahnya lagi.

![]()

He Loves Me Too Much And Doesn T Fight Up Woman Seeks Divorce In Sharia Court Sharia Court Divorce Dissolution Of Marriage

Borang Permohonan Moratorium Bank Islam Pemulih Mulai 7 Julai 2021

Moratorium Series 2 Bank Islam Properly

Bank Islam Offers Financial Help To 5 251 Customers Since Mco 3 0 On June 1

Bank Islam Contact Banks To Extend Moratorium

Bernama Bank Islam Offers 6 Month Deferment Of Financing Repayments

Bank Islam Offers Moratorium For Flood Victims The Star

Bank Islam Continues Post Moratorium Assistance

Invitație Intr Un Grup Whatsapp Coin Master Hack Spinning Masters Gift

Moratorium Series 2 Bank Islam Properly

What Is An Msme Loan Small And Medium Enterprises Loan Business Loans

Pin On Oneplus Bse Sensex Malaysia Corporate Social Responsibility Jammu And Kashmir Zakir Naik Rahul Gandhi Reliance Industries Limited Saudi Aramco India

Financial Ratios Islamic Banks Vs Conventional Banks Download Table

Pdf Factors Affecting Non Performing Loans In Pakistan During The Covid 19 Pandemic A Case Of Micro Finance Banks

Comments

Post a Comment